Following Nvidia’s Earnings, a Top Analyst Says the AI ‘Boom Is Just Starting’

/NVIDIA%20Corp%20video%20chip-by%20Antonio%20Bordunovi%20via%20iStock.jpg)

Semiconductor champion Nvidia (NVDA) delivered another more-than-solid earnings report after the closing bell on Wednesday, Aug. 27, showing earnings of $46.7 billion, up 56% year over year despite having no sales of its H20 chip in China. And while the stock slipped slightly after earnings, Nvidia got a huge endorsement today from one of Wall Street’s top tech analysts.

“I think the boom is just starting,” Wedbush Securities senior analyst Dan Ives told Bloomberg. “I mean, if you look at these numbers, especially when you factor in where China’s going to be, I mean, [CEO Jensen Huang] talked about $50 billion, 50%-type growth number. This just shows the next stage of adoption is actually just starting. I think the stock is green today.”

About Nvidia Stock

Headquartered in Santa Clara, California, Nvidia is the leading semiconductor company in the world, specializing in graphics processing units (GPUs) that are used to operate the most sophisticated and challenging programs that power artificial intelligence and machine learning. Nvidia’s products are most in demand from data center operators who link hundreds of GPUs together to have them perform in tandem. The explosion in AI has pushed Nvidia to become the most world’s valuable publicly traded company with a market capitalization of $4.4 trillion.

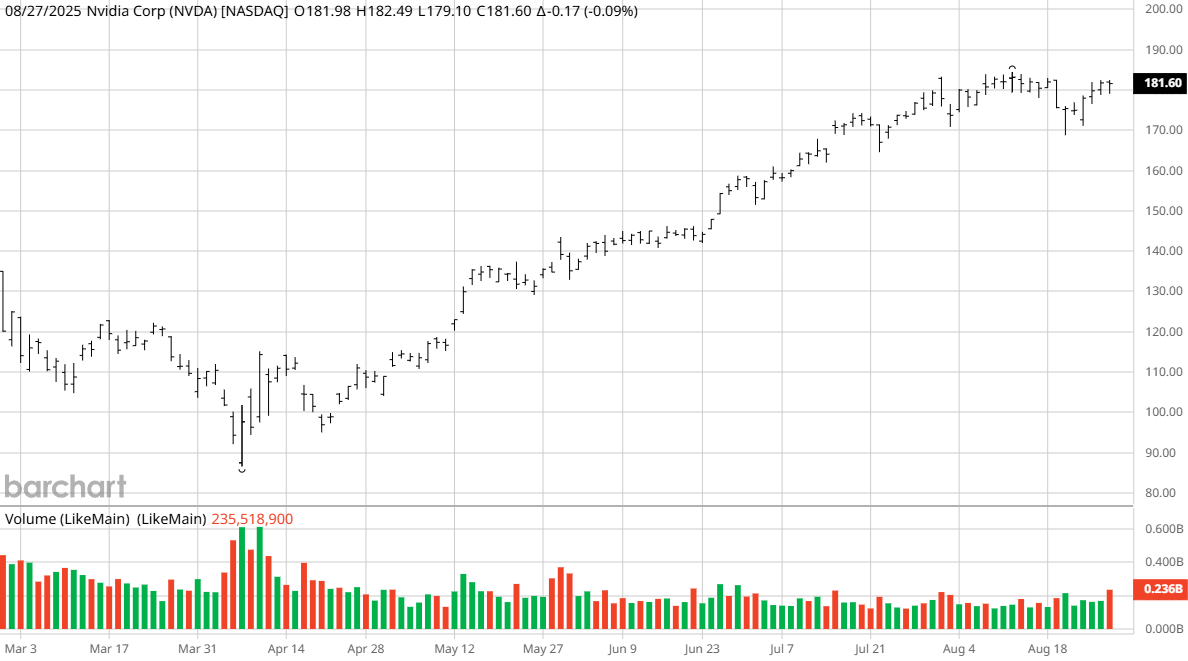

Nvidia stock continued its huge rise over the last year, jumping 41%, solidly ahead of competitors Advanced Micro Devices’ (AMD) 15% jump and Intel’s (INTC) 27% climb. Nvidia is also beating the larger market, as the Nasdaq Composite Index ($NASX) is up just 23% in the last year.

In terms of valuation, Nvidia has a trailing price-earnings ratio of 59.6x, which is close to its 10-year average P/E of 58.8x, indicating that earnings expectations are well in line with its historical norms.

Nvidia Beats on Earnings

Nvidia reported earnings on Wednesday for its second quarter of fiscal 2026 (ending July 27, 2025). Revenue was $46.74 billion, up 56% from a year ago and increasing by 7% from last quarter. Net income was $26.42 billion and $1.08 per share, up from $16.59 billion and $0.67 per share in the same quarter a year ago. Analysts were expecting revenue of $46.06 billion and EPS of $1.05.

Notably, Nvidia said that even though it was unable to sell its H20 chips in China, the company said it benefited from a $180 million release of previously reserved H20 inventory. It was also able to realize $620 million in H20 sales to a customer outside of China.

Nvidia made the H20 chips specifically for the Chinese market in order to comply with U.S. export restrictions on advanced AI semiconductors. The H20 chips are less advanced than Nvidia’s flagship Hopper H100 chips, but they are optimized for large language model inference and are capable of running some AI workloads 20% faster despite their lower power.

Nvidia is working on a deal with U.S. officials to allow it to sell the H20 in China in exchange for 15% of sales, but disclosed Wednesday that the arrangement is not final yet. In addition, regulators in China have asked tech companies and developers not to use the H20 for sensitive operations, leaving future sales in doubt. Nvidia’s revenue from China was $17.1 billion last year, or roughly 13% of the company’s total sales.

Nvidia said it could ship between $2 billion and $5 billion in H20 revenue in the third quarter, and potentially more, should geopolitical issues resolve.

What Do Analysts Expect for Nvidia Stock?

Speaking to Bloomberg TV this morning, Ives argues that while investors may have initially been disappointed with the lack of H20 sales in China, the company’s growth story is still powerful – and the market will realize that before the end of the day.

“The reality is when you look at data center, and when you actually factor in where China’s going to be when you look at $2 [billion] to $5 billion, and you look at the acceleration in the next few quarters, there’s no reason it’s not accelerated,” Ives said. “And now in China with the pay for play model back in, you’re talking about what could be an incremental $20, 25, $30 billion. That’s what it comes down to.”

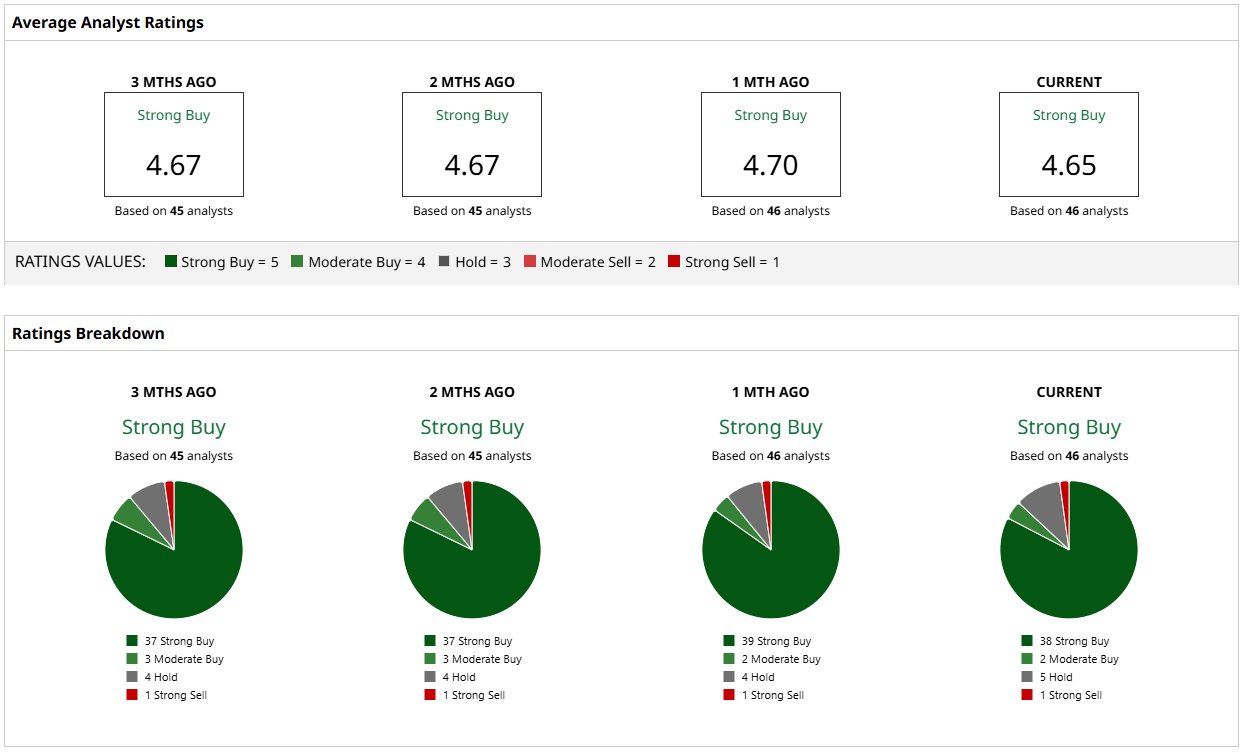

While Ives may be the most vocal bull, Wall Street analysts in general list Nvidia stock as a “Strong Buy.” Of 46 analysts, 38 have the stock as a “Strong Buy,” two list it as a “Moderate Buy,” and five suggest a “Hold.” Only one analyst lists Nvidia as a “Strong Sell.”

With a median price target of $199, analysts are suggesting a potential increase of 10% in the coming months – and the most bullish analyst’s target of $250 suggests a possible increase of 38%.

The post-earnings slip in Nvidia stock should be seen as an overreaction. Nobody should have been surprised with the lack of H20 revenue in China considering the reservations from both U.S. and Chinese regulators. However, Nvidia is continuing to grow without sales in China, and its next-generation Blackwell chip sales jumped 17% sequentially.

Ives says that Nvidia’s report is a bullish sign for both Nvidia and tech stocks in general. Nvidia appears to be a strong buy following its earnings report.

On the date of publication, Patrick Sanders had a position in: NVDA . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.