Chipotle Mexican Grill Stock Outlook: Is Wall Street Bullish or Bearish?

/Chipotle%20Mexican%20Grill%20storefront%20by-%20Anne%20Czichos%20via%20Shutterstock.jpg)

With a market cap of $57.2 billion, Chipotle Mexican Grill, Inc. (CMG) operates fast-casual restaurants that specialize in burritos, bowls, tacos, salads, and related menu items made with responsibly sourced ingredients. Headquartered in Newport Beach, California, Chipotle also offers digital ordering and delivery through its app and website.

Shares of Chipotle Mexican Grill have lagged behind the broader market over the past 52 weeks. CMG stock has dropped 23.8% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 15.8%. In addition, shares of the company are down 29.5% on a YTD basis, compared to SPX’s 10.1% increase.

Focusing more closely, the Mexican food chain company stock has also underperformed the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 27.1% return over the past 52 weeks.

Despite beating expectations with Q2 2025 adjusted EPS of $0.33 on Jul. 23, Chipotle shares tumbled 13.3% the next day as revenue of $3.1 billion missed forecasts and comparable sales dropped 4%, steeper than the decline analysts expected. Management cut its annual comparable sales outlook to flat from prior low single-digit growth, citing weaker consumer demand amid higher menu prices, economic uncertainty, and a 6% drop in visits per location versus a flat trend for the broader fast-casual segment.

For the fiscal year ending in December 2025, analysts expect CMG’s adjusted EPS to grow over 8% year-over-year to $1.21. The company's earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

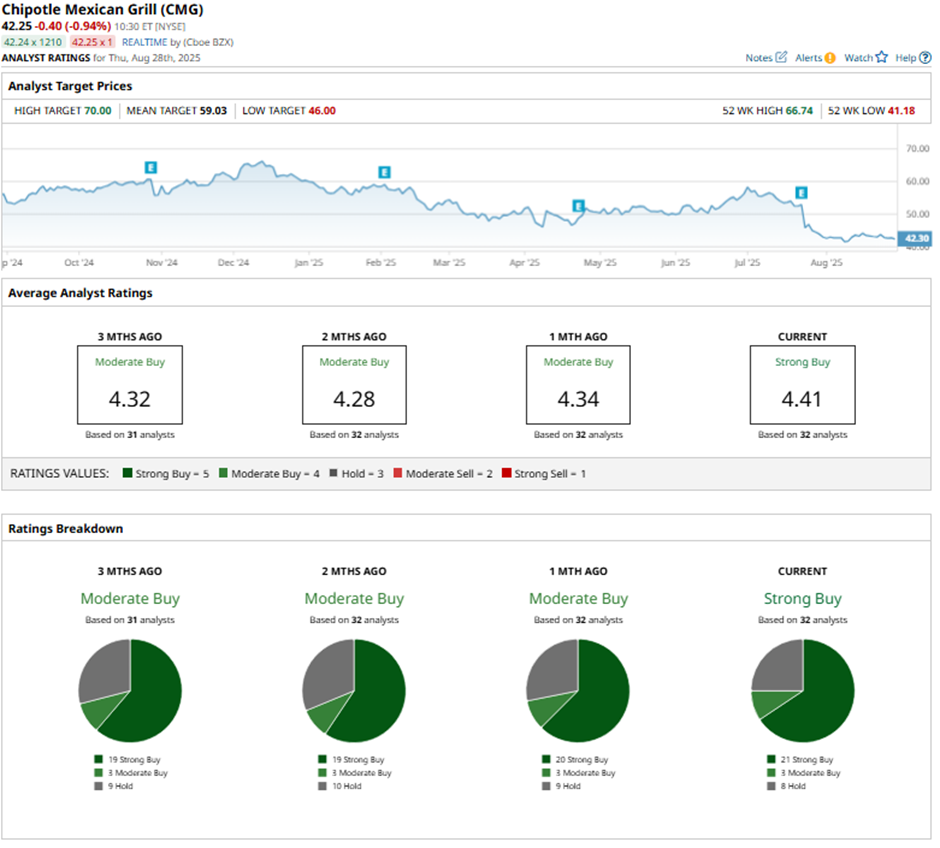

Among the 32 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 21 “Strong Buy” ratings, three “Moderate Buys,” and eight “Holds.”

This configuration is more bullish than three months ago, with 19 “Strong Buy” ratings on the stock.

On Jul. 30, Bernstein analyst Danilo Gargiulo reiterated a “Buy” rating on Chipotle with a $65 price target.

The mean price target of $59.03 represents a 39.7% premium to CMG’s current price levels. The Street-high price target of $70 suggests a 65.7% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.